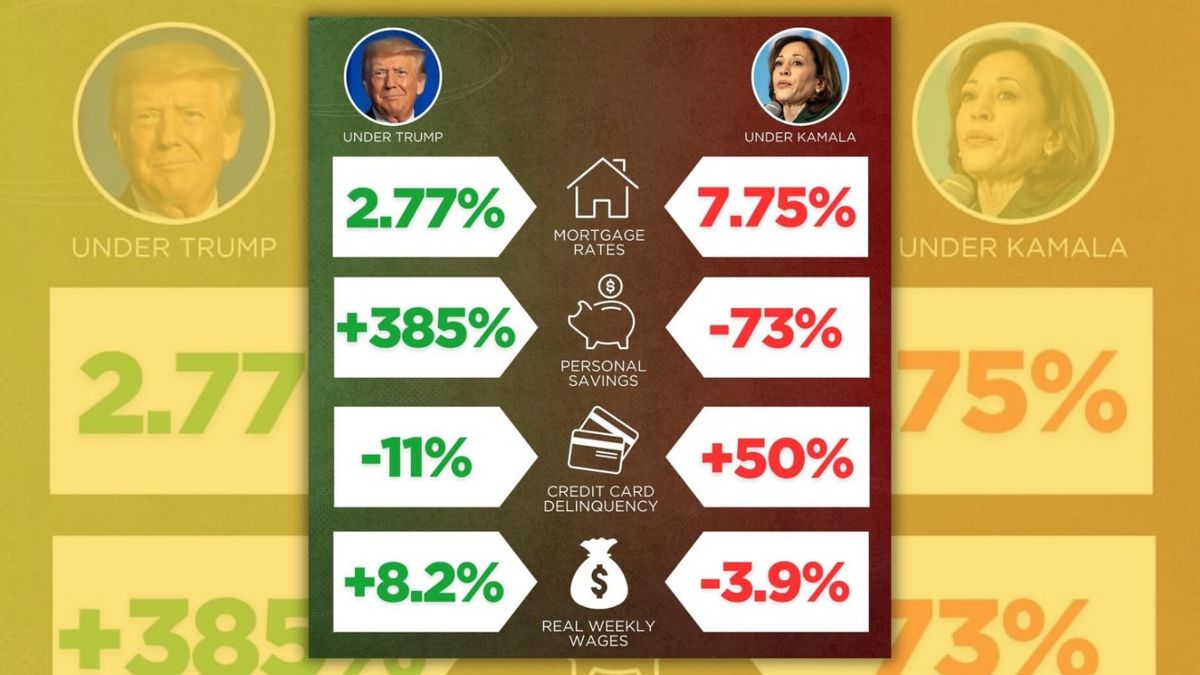

In September 2024, as the U.S. presidential election gathered momentum, a meme began to circulate purporting to compare data on the spending power of households between the administration of former U.S. President Donald Trump and the administration of his 2024 opponent, Vice President Kamala Harris. It appeared on Trump's official Facebook page (archived) on Sept. 5:

As of this writing, this post had gained 78,000 reactions and 13,000 comments. The meme also appeared elsewhere on Facebook, including the Facebook page of the Republican Party of Kalamazoo County in Michigan, several X posts, and Reddit. A user also posted another version of it on Instagram.

The first thing to note about the meme is that Harris was not the president. Rather, she served under Joe Biden as he led the country.

Excepting that, the meme, which did not cite any sources, either made inconsistent comparisons, failed to remind viewers of exceptional circumstances —namely, the economic effects of the COVID-19 pandemic — or used numbers we couldn't reproduce.

Mortgage Rates

On the topic of mortgage rates, the creator of the meme appears to have chosen one of the highest possible rates attained under Biden and the one of the lowest reached under Trump, making them incomparable. Based on the rates used, it seemed most likely that the account was referring to the 30-year fixed mortgage average in the U.S. since 1971 — data compiled by Freddie Mac and charted by the St. Louis Federal Reserve. That rate hit 4.94% at its maximum under Trump in November 2018 as the Fed raised its federal funds rate to the 2% to 2.25% range from 1.25% to 1.5% in January of that year. The Fed rate remained in the 1.5% to 1.75% range until the COVID-19 pandemic started, at which point the Fed lowered its rate to the 0% to 0.25% range so as to stave off an economic recession. This is the period when the mortgage rate fell, reaching a low of 2.66% two weeks before Biden took office.

Then inflation began to accelerate under Biden as activity across the country resumed, prompting the Fed to raise its rates in March 2022 to prevent the economy from overheating. The federal funds rate reached a peak in the 5.25% to 5.5% range, where it remained until the Fed lowered it

Crucially, the Fed's independence from the White House and Congress guarantees that no elected official, president included, can influence rates decisions.

The meme uses inexact numbers and makes a comparison on a matter over which a sitting president has no control.

Personal Savings

The meme claimed that personal savings rose 385% under Trump and fell 73% under Biden. It wasn't immediately clear where those numbers came from, as the statistic that economists favor is the personal saving rate, calculated each month as the ratio of personal savings to disposable personal income.

Tracked since 1959, this rate indeed reached a record high of 32% in April 2020 as the COVID-19 pandemic hit the country, forcing people inside their homes and preventing them from spending as much money as they normally would. That rate then fell sharply to 12% as the summer season arrived and people began to attempt more outings and spent more of their disposable income. In March 2021, two months into Biden's term, as another wave of COVID-19 swept the country and while the government rolled out the first round of vaccines, the personal saving rate rose to 26.1%. Economic activity resumed in earnest after vaccines became widespread, and the savings rate fell as inflation accelerated mid-2022.

Looking at personal savings in absolute terms, we calculated the evolution of savings between the start of each of president's term and the peaks that personal savings hit, in billions of dollars. Here's what we found:

- From the moment Trump took office in January 2017 to the second quarter of 2020, when personal savings reached a peak, savings rose 500.33%.

- From the moment Trump took office to when he left in January 2021, personal savings rose 189.40%.

- From the moment Biden took office to when personal savings reached a peak two months later, savings rose 82.50%.

- From the moment Biden took office to the second quarter of 2024 — the last quarter for which there was data as of this writing — personal savings dropped 68.80%.

We could not find the numbers the meme referred to,

Credit Card Delinquency

The meme said credit card delinquencies fell 11% under Trump and rose 50% under Biden, but once again there was no clarity as to what the maker of the meme based these percentages on. We looked at the monthly credit card delinquency rate and found that, much like the personal savings rate, it tracked the pandemic's ebb and flow with a three- to six-month delay, following an inverse correlation: When the pandemic got worse, people stayed home and delinquencies dropped.

The credit card delinquency rate reached a then-historical low in the third quarter of 2020, falling to 2%. It continued to fall after Biden took office, hitting its record low of 1.54% in the third quarter of 2021. As economic activity resumed and people began to spend more money, the rate began to rise once more, remaining below historical levels. It reached a high of 3.25% in the second quarter of 2024, the last period for which there was data as of this writing.

While we could not find the exact amount of credit card delinquencies in dollars, we looked at delinquencies in dollars on on all loans and leases to consumers, which included credit cards. Making the same calculations as for the personal savings rate, we found the following:

- From the moment Trump took office in January 2017 to the third quarter of 2020, when delinquencies reached a low, they dropped 17.62%.

- From the moment Trump took office to when he left in January 2021, loan delinquencies fell 7.10%.

- From the moment Biden took office to when delinquencies reached a low in the second quarter of 2021, they dropped 34.55%.

- From the moment Biden took office to the second quarter of 2024 — the last quarter for which there was data as of this writing — delinquencies rose 88.93%.

We could not find the numbers the meme referred to, though delinquencies dropped under Trump when the pandemic started.

Real Weekly Wages

The meme claimed real weekly wages increased 8.2% under Trump and fell 3.9% under Biden. The data compiled by the U.S. Bureau of Labor Statistics and charted by the St. Louis Fed showed that, indeed, real wages rocketed during the COVID-19 pandemic, reaching a historical height of $393 — a number based on 1982-84 inflation-adjusted dollars — in the second quarter of 2020.

This is due to the fact that low-paying jobs disappeared during the height of the pandemic while workers with higher-paying jobs adapted to remote work, pushing the average up, according to the Economic Policy Institute. As the effects of the pandemic subsided and economic activity picked up and inflation accelerated, real weekly earnings fell in the second quarter of 2022. Still, they remained in a historically high range. As we did with personal savings and loan delinquencies, we calculated the evolution of real weekly wages from the start of each of their mandates to subsequent peaks, and then from the beginning of their mandates to the end:

- From the moment Trump took office in January 2017 to the second quarter of 2020, when real weekly wages reached a peak, they rose 12.61%.

- From the moment Trump took office to when he left in January 2021, real weekly earnings rose 7.74%.

- From the moment Biden took office to when real weekly earnings dipped in the second quarter of 2022, wages fell 4.5%.

- From the moment Biden took office to the second quarter of 2024 — the last quarter for which there was data as of this writing — real weekly earnings dropped 2.5%.

Here, too, we could not find the numbers to which the meme referred, though real weekly wages spiked during the Trump administration after the pandemic started.